The Alert Factor, Securing Your Family's Future Today, and Tomorrow by Factoring Customized Strategies, like multi-family units and Life Insurance Products with Living Benefits for Lifelong Financial Security!

What is Mortgage Protection?

Mortgage protection is a type of insurance policy specifically designed to cover the cost of your mortgage if you’re unable to make payments due to life’s unexpected challenges. Here’s a deeper dive into its use and examples of how it can benefit you:

How Does Mortgage Protection Work?

Mortgage protection typically ensures that:

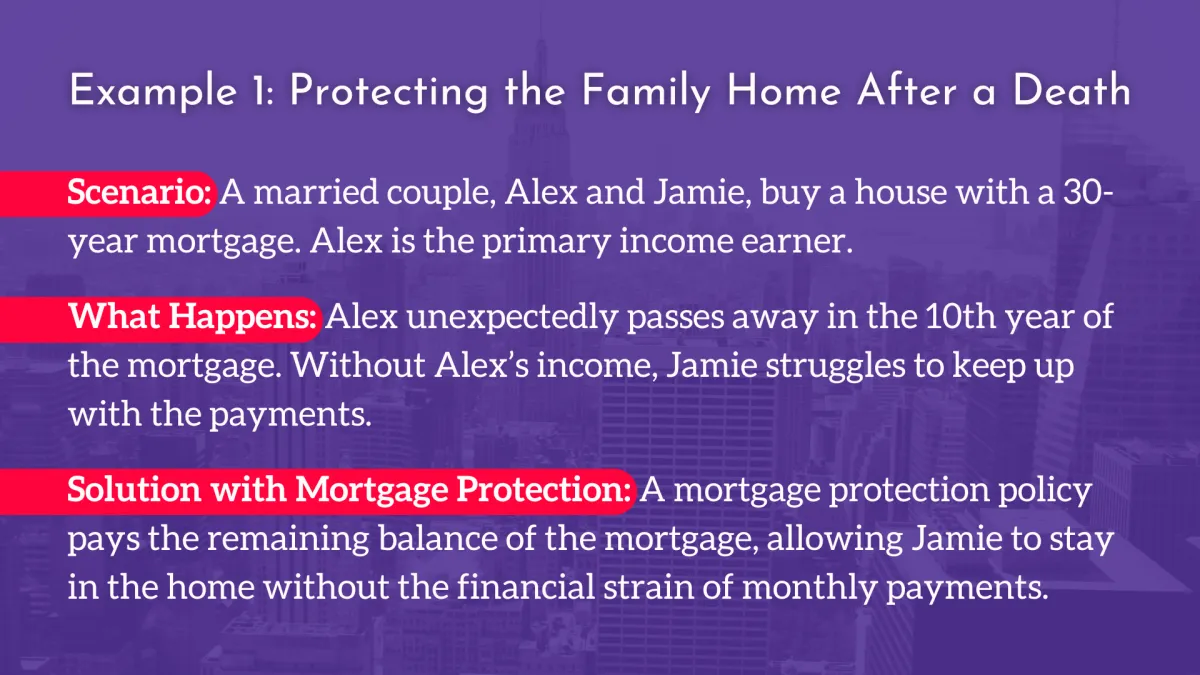

If the Policyholder Passes Away: The policy pays off the remaining mortgage balance, preventing the family from losing the home.

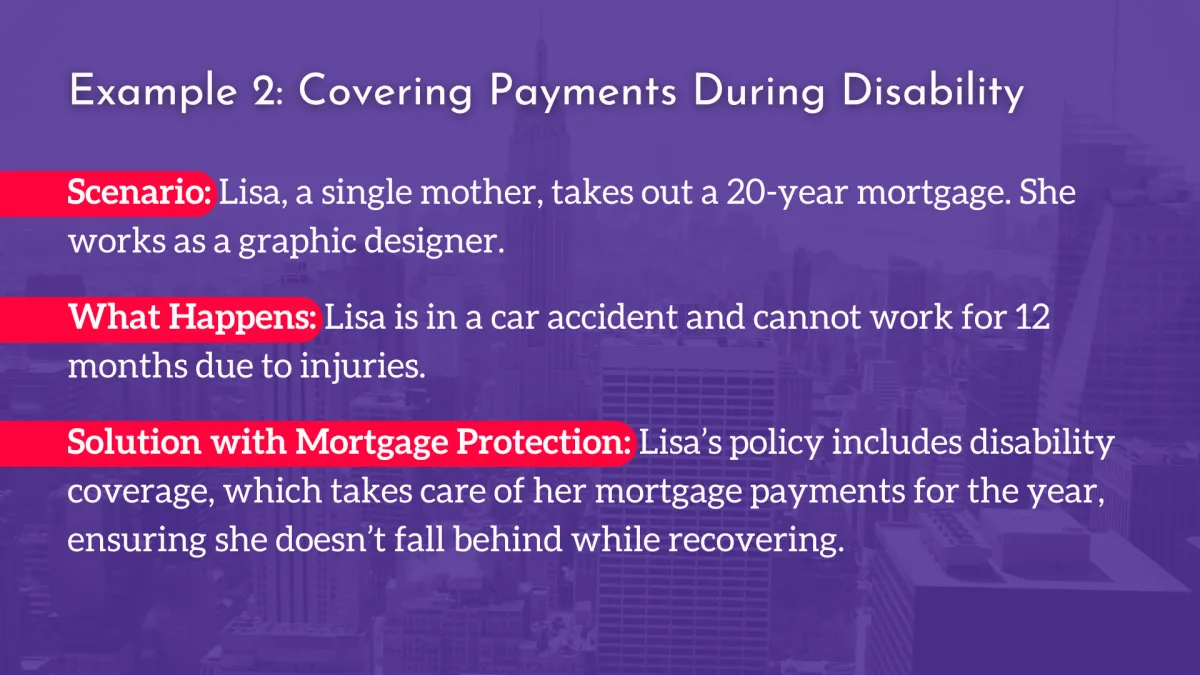

If the Policyholder Becomes Disabled: The policy can cover monthly mortgage payments while the policyholder recovers or adapts to a new situation.

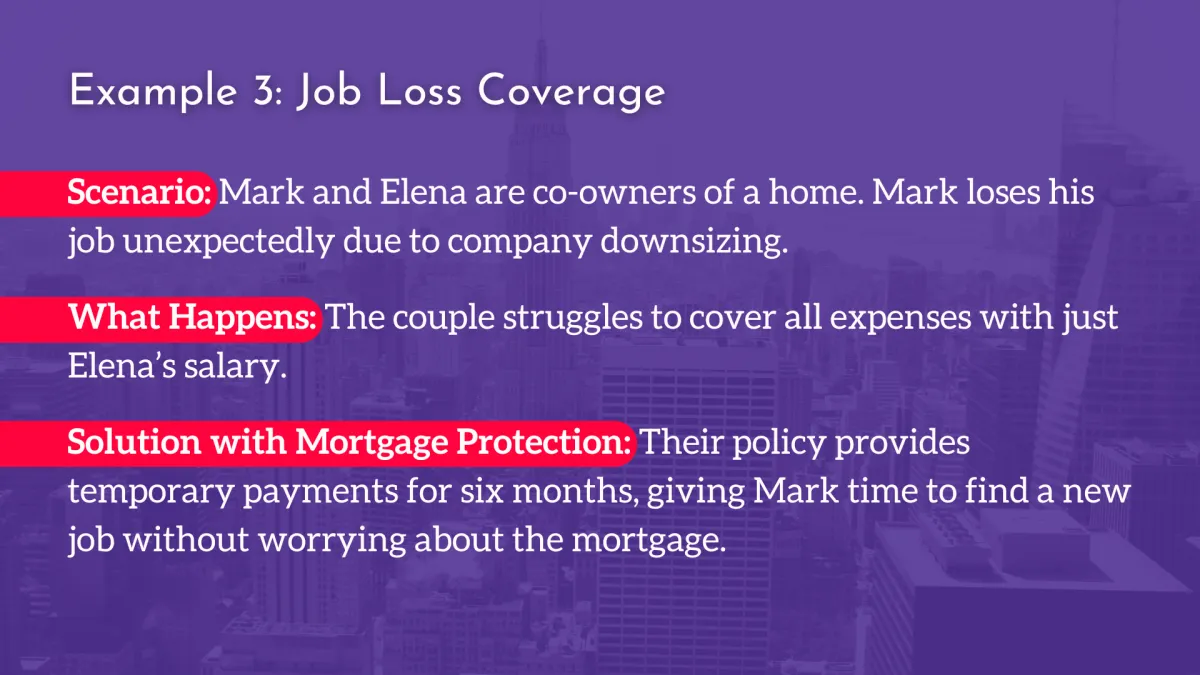

If the Policyholder Loses Their Job: Some policies offer temporary payment coverage during periods of unemployment, reducing stress and allowing time for the homeowner to find new employment.

Examples of Using Mortgage Protection

How to Use Mortgage Protection in Financial Planning

Include it in Your Budget: Decide how much coverage you need based on your mortgage balance and your family’s financial situation.

Choose Additional Features: Add riders like disability or unemployment coverage to protect against more specific risks.

Review Regularly: As you pay down your mortgage or experience life changes (like marriage, children, or job changes), adjust your coverage.

How can Nancy Alert Help?

Tailored Solutions: Nancy will work with you to analyze your mortgage terms, family needs, and budget to find the best policy.

Wealth-Building Strategy: Nancy can integrate mortgage protection into a larger financial plan, helping you build passive income through multi-family real estate investments.

Holistic Guidance: Beyond securing your home, Nancy can advise on life insurance and other tools to protect your assets and grow generational wealth.

By using mortgage protection effectively, you gain peace of mind knowing that your home and family are secure, no matter what life throws at you.

Check these out!

Frequently Asked Questions

WHAT SERVICES DO YOU OFFER?

I offer comprehensive real estate services, including investment opportunities in residential and commercial properties, real estate development, construction, and multi-unit deals. My expertise extends to condo conversions, off-market deals, securing funding from $100K to $350M, and providing no-doc loans for investment properties. Additionally, I provide coaching, consulting, and speaking services on creating passive income and wealth through real estate investments and life insurance products.

WHAT INDUSTRIES DO YOU SERVE?

I serve the real estate industry, focusing on residential and commercial investments. My clients include seasoned and new investors, developers, asset managers, and individuals interested in buying, selling, and investing in multi-family units, buildings, and other real estate opportunities in Washington DC, Maryland, and Virginia.

Buying a multi-family unit, such as a duplex, triplex, quad, or apartment building, can be a strategic and financially rewarding decision for various reasons. Here are some compelling reasons why you might consider pursuing a multi-family property:

Coaches, Consultants, Thought-Leaders, Authors, Speakers & Movement Leaders who want to take their brand to the cutting-edge of marketing and increase their speaking, coaching or consulting fees while disrupting their market with a powerful sales-getting evergreen Documentary.

Business Owners & Entrepreneurs who want to showcase their brand, company, product or clients in a compelling, immersive & industry-defying way to create celebrity authority and increase perceived value of the product.

An Established Brand Wanting To Engineer A New Product Launch, Brand Launch, Conference or Event To Sell Out Seats, Product and Beyond. A Salesumentary debut is an EVENT even your most skeptical prospects will be excited to watch -- ultimately creating customers from people who have been on the sidelines for years.